With ten months to go until the Plastic Packaging Tax comes into effect, are you and your suppliers getting prepared? From the 1 April 2022, this new tax of £200 per metric tonne will apply to plastic packaging manufactured in, or imported into, the UK which contain less than 30% recycled plastic.

Although we have previously highlighted that this tax may have unintended consequences of generating more packaging waste, the aim of the policy is to encourage the use of, and increase demand for, recycled plastic within packaging.

So what can your suppliers and manufacturers do, to be prepared for the change? Final guidance is due from the government later this year, once the legislation currently going through parliament becomes law, however the following 5 key steps are a solid starting point:

1. Record keeping

Businesses should keep records of the packaging they manufacture or import, showing the weight and proportion of recycled plastic content of packaging, even if it contains more than 30%. Your suppliers and manufacturers will still need to maintain records showing they are below the tax threshold.

For packaging that contains multiple materials, suppliers and manufacturers must record all these, including weights used in the manufacturing process, to demonstrate that plastic is not the main material overall and not liable for the tax.

If you are a business that supplies recycled plastic, your business customers may want more information from you about the types and quantities of material you supply to them.

2. Prepare for changes to invoice systems

If you are responsible for accounting for the tax as an importer or manufacturer of plastic packaging then any invoice you issue to a business customer must show a statement that Plastic Packaging Tax has been paid on the packaging concerned. It’s not clear yet what form this statement should take, but responsible suppliers should be ready to make the necessary changes via their invoicing software and explain the changes to customers. Customers should be encouraged to make sure their suppliers have fulfilled their responsibilities, as they could find themselves liable to pay tax if they haven’t.

3. Prioritise plastic packaging containing at least 30% recycled plastics

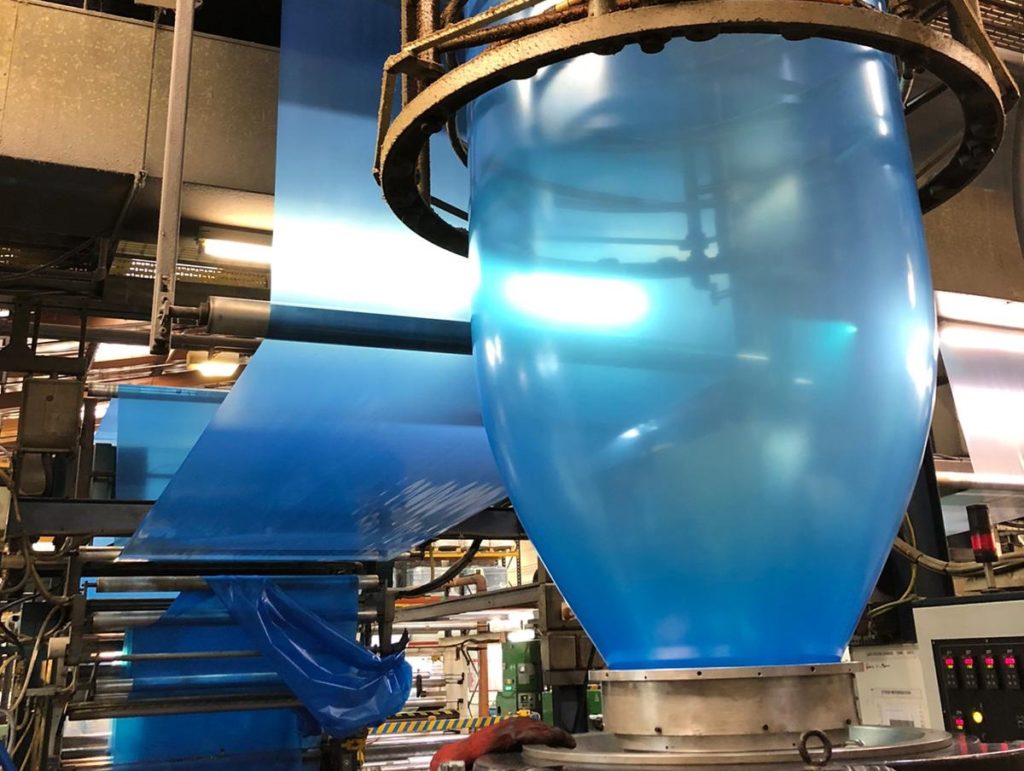

Our organisation, and many within the plastics packaging industry, already provide a high level of recycled content in our products. In fact, in many cases, responsibly produced plastic can have a high recycled content of up to 100 per cent. Through our UK manufacturing and recycling divisions, we help our customers in diverse industry sectors, including uPVC profile extrusions, carpet and textiles, roofing and guttering, and disposable products, to meet their sustainability goals.

4. Choose suppliers who meet industry standards

We already work to ensure that recycling, and processing of polythene, meets recognised industry and customer standards, including the use of EUCertPlast certified materials. This recognises the highest standards of material traceability, process control and quality of the recycled content in the end-product. This enables us to replace virgin plastic with recycled materials through successful trials in a variety of industry sectors.

As a member of the British Plastics Federation, we also support WRAP’s UK Plastics Pact which aims to eliminate all avoidable plastic packaging waste and make all plastic packaging reusable, recyclable, recycled, or compostable, by 2025.

What’s next?

You should check current government guidance about the Plastic Packaging Tax, available here, which will updated later this year.

The legislation also requires a business that manufactures or imports ten or more tonnes of plastic packaging over a 12-month period to register for the tax by 30 April 2022 (even if you are eventually not liable to pay). The online service to register and pay via HMRC will be available on 1 April 2022, when the tax takes effect.

The four exemptions from the tax are plastic packaging for medical products; transport packaging used on imported goods; packaging for aircraft, ship, and rail; and components that are permanently designated or set aside for use other than packaging.

We are in constant dialogue with our customers and suppliers about the impact of the Plastic Packaging Tax. Our friendly team is only a phone call away and is ready to offer support and advice. Contact us today on 01977 686 868, info@cromwellpolythene.co.uk, or visit our website https://www.cromwellpolythene.co.uk/